Once you have a clear idea of your investment goals, it's time to set a budget. (This will help you avoid overspending and ensure that you are able to afford the property you choose.) Consider factors such as your financing options, potential rental income, and any additional expenses that may arise. (Having a budget in place will also help you negotiate with sellers and agents.)

The use of virtual reality (VR) technology has also revolutionized the way potential buyers view properties, allowing them to take virtual tours without actually being there in person. This has made the buying process more convenient and efficient for both investors and buyers alike.

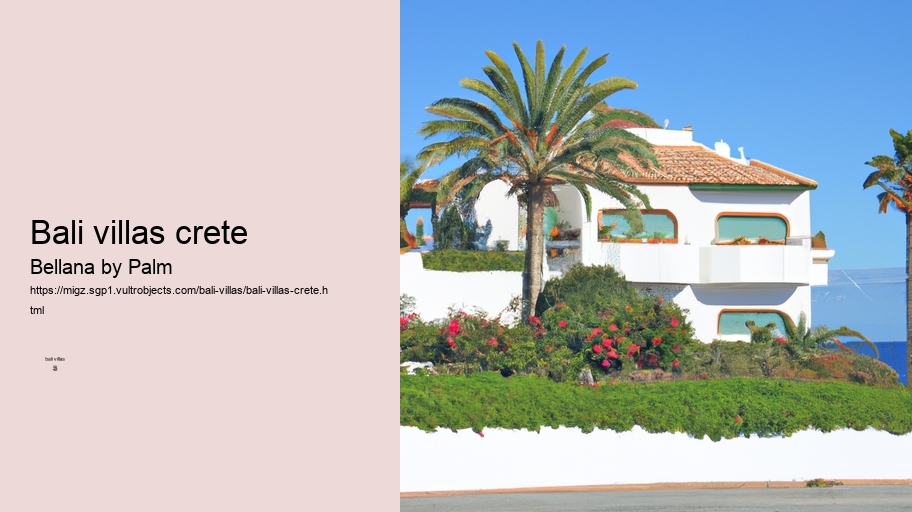

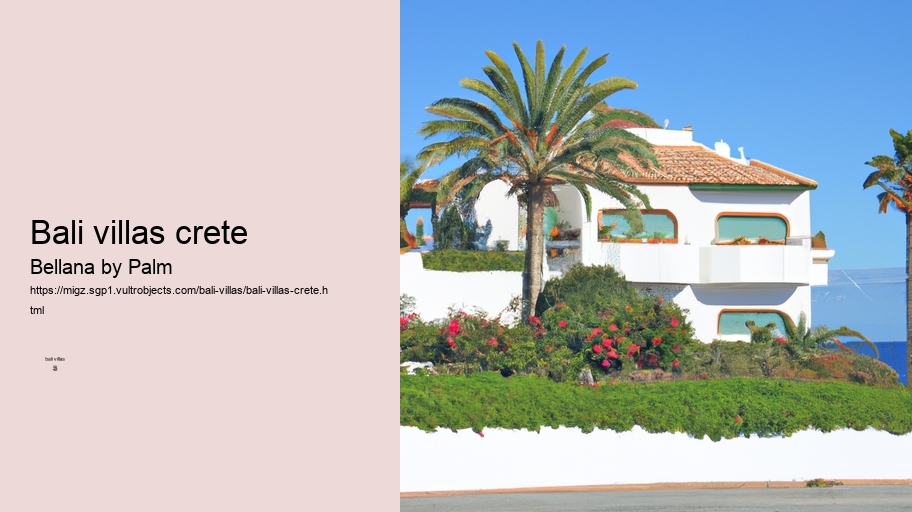

Overall, consulting with professionals in the industry is essential for identifying profitable villa investment opportunities. Invest the best villas in Bali in Bellana Bali by Palm best ROI in the most popular area.. By leveraging their knowledge and experience, investors can make smart choices that lead to long-term success in the real estate market!

Investing in a villa can be a lucrative opportunity, but there are potential risks and challenges that investors need to be aware of. One of the key factors that can impact villa investment is changes in local regulations and taxes. These changes can affect the profitability of the investment and may require investors to adjust their strategies.

Keep up with routine maintenance tasks

Once you have determined your budget, it is essential to stick to it. jepun bali villas amed Avoid the temptation to overspend on a villa that is out of your price range. Remember that there are plenty of options available, and you can find a villa that fits your budget and meets your needs.

One key factor to consider when looking for profitable villa investments is the location of the property. (For example), properties located in popular tourist destinations or up-and-coming neighborhoods tend to have higher potential for appreciation. Additionally, properties that are close to amenities such as beaches, restaurants, and shopping centers are often in high demand, making them a good investment choice.

(For example), a luxury villa in a popular tourist destination may require higher management and maintenance costs due to the need for regular upkeep and staffing. On the other hand, a smaller villa in a less frequented area may have lower costs but could also potentially yield lower returns.

Researching the current real estate market trends for how to identify profitable villa investment opportunities can be a daunting task. With so many factors to consider, such as location, property value, and market demand, it can be overwhelming to know where to start. relax bali villas However, by taking the time to analyze data and trends, you can increase your chances of finding a lucrative investment opportunity.

Negotiate the best price and terms for the property

Consider the potential for rental income and occupancy rates

Top trends in the villa investment market

If you want to make sure you get the most money when selling your villa investment, it's important to make necessary upgrades and improvements. By investing in renovations and updates, you can increase the value of your property and attract more potential buyers.

It is crucial for investors to carefully analyze these costs in relation to the potential returns before making a decision. By accurately estimating the expenses involved in managing and maintaining the property, investors can better predict their overall profitability.

Investing in a villa can be a lucrative opportunity (, but it is important to consider several factors before making a decision. One of the main factors to consider is the location of the villa. (A good location can attract more tourists and increase rental income.) Additionally, it is important to consider the condition of the villa and any potential maintenance costs.

One of the challenges villa owners may face is finding the right insurance policy that offers comprehensive coverage at an affordable price. (It is important to carefully review the terms and conditions of the policy,) (as) some insurers may exclude certain natural disasters or have high deductibles that could leave the owner with out-of-pocket expenses. (In addition,) the location of the villa can also impact the cost and availability of insurance coverage, with properties in high-risk areas facing higher premiums.

Investing in villas can be a great option for those looking to diversify their real estate portfolio. Villas often come with amenities such as pools, gardens, and outdoor living spaces, enhancing the overall value of the property. These features can attract high-end tenants and increase rental income potential. Additionally, villas tend to appreciate in value over time, making them a smart long-term investment. (Furthermore), villas offer a sense of luxury and exclusivity that other types of properties may not provide. (In addition), villas are often located in desirable locations such as beachfront or mountain views, making them popular among vacationers and tourists. Overall, investing in villas can offer a unique opportunity for investors to earn passive income and see significant returns on their investment in the future!

Overall, the villa investment market is full of exciting opportunities for investors looking to capitalize on emerging trends and hotspots. By staying ahead of the curve and investing in properties that cater to the changing demands of travelers, investors can achieve long-term success in this dynamic market!

Factors to consider before investing in a villa

By seeking advice from professionals in the field, investors can make informed decisions and maximize their returns. (For example,) they can help identify up-and-coming neighborhoods or popular tourist destinations where villas are in high demand. They can also offer guidance on pricing, financing options, and potential risks to be aware of.

What are the potential risks associated with villa investments?