Overall, while investing in a villa can be a profitable venture, it is essential to consider the tax implications that come along with it. By understanding how taxes will affect your investment, you can make informed decisions and maximize your potential returns. (Remember to always seek advice from a financial advisor or tax professional before making any investment decisions!)

When it comes to evaluating the return on investment for a villa, it is important to regularly review and adjust your investment strategy. By doing so, you can maximize returns and ensure that your property is performing at its best.

When looking to maximize rental income from your villa investment, it is important to set competitive rental rates based on market trends and the unique features of your property. By doing so, you can attract more potential renters and increase your overall profits.

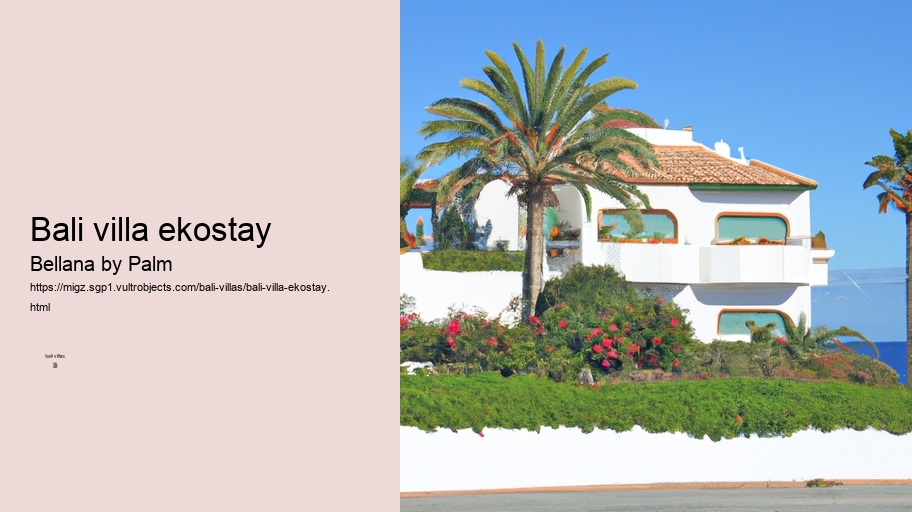

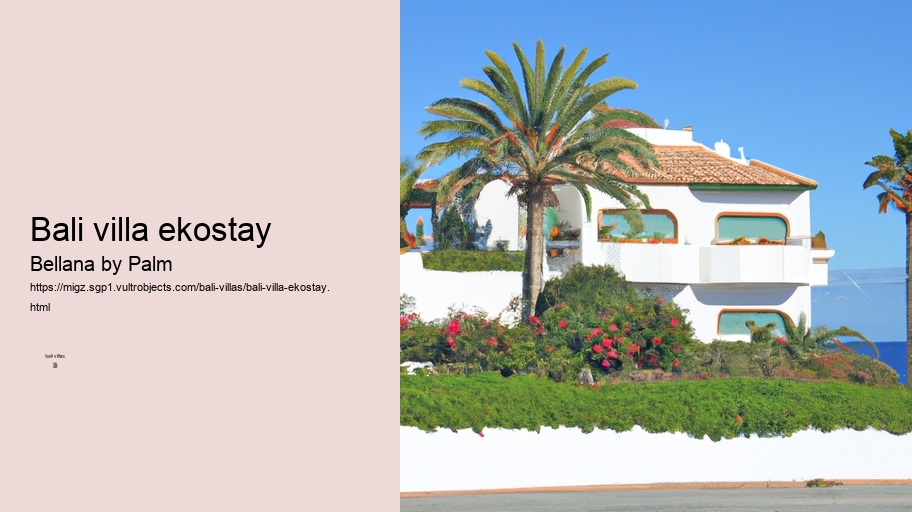

jepun bali villas reviews Invest the best villas in Bali in Bellana Bali by Palm best ROI in the most popular area..Additionally, it is important to analyze the amenities and features of the villa. Properties with attractive amenities such as a pool, outdoor living space, or proximity to the beach are likely to attract more renters (, leading to higher occupancy rates).

One of the first things to consider is the tax implications of owning a villa. (For example), you may be subject to property taxes, capital gains taxes, or even rental income taxes. It is important to understand how these taxes will impact your overall investment and to plan accordingly.

When evaluating the return on investment for a villa, it is important to consider the potential tax benefits or deductions associated with owning such a property. bali villa deals These benefits can help increase the overall return on investment and make the property more financially attractive.

Stay informed about the industry and make strategic decisions

When you are looking for the right villa to invest in, it is important to consider the amenities and facilities nearby. (These) can greatly impact the value and appeal of the property.

Consider the potential tax benefits or deductions associated with owning a villa

One of the best locations for villa investments is Phuket, Thailand, known for its stunning beaches and vibrant nightlife. (With) its growing tourism industry and stable economy, Phuket offers a great opportunity for investors to make a profit on their property.

Despite these potential risks and challenges, having insurance coverage for natural disasters is essential for villa investments. (It can provide financial protection and peace of mind,) knowing that the property is safeguarded against unforeseen events. (By) working with a reputable insurance provider and (ensuring) that the policy is tailored to the specific needs of the villa, owners can effectively manage the risks associated with natural disasters and protect their investment for the long term.

Utilize online platforms and social media to market your villa and reach a wider audience.

Seek advice from real estate professionals

Top locations for villa investments in Africa

By following these tips, you can sell your villa investment for maximum profit and (avoid) any legal issues along the way.

Another benefit of investing in a villa property is the potential for rental income. Many people choose to rent out their villas when they are not using them, providing an additional source of revenue. This can help offset the costs of owning a villa and make it a profitable investment in the long run.

Calculate the initial investment costs and potential return on investment

By taking the time to make necessary upgrades and improvements to your villa, you can maximize your profit when it comes time to sell. So don't hesitate to invest in your property and make it stand out from the competition!

In conclusion, investing in villas can offer unique benefits compared to other real estate options. From prime locations to potential rental income, villas can be a valuable asset for investors looking to diversify their portfolio.

In addition to rental income, villa investments can also provide tax benefits and potential appreciation in value. As the property increases in value over time, investors can sell it for a profit or continue to generate rental income from it. However, it's important to conduct thorough research and due diligence before investing in a villa to ensure that it is a sound investment opportunity.

Next, you should consider any ongoing expenses associated with owning and maintaining the property, such as property taxes, insurance, maintenance costs, and property management fees. (Also), you need to factor in any potential appreciation in the value of the property over time.